Contents

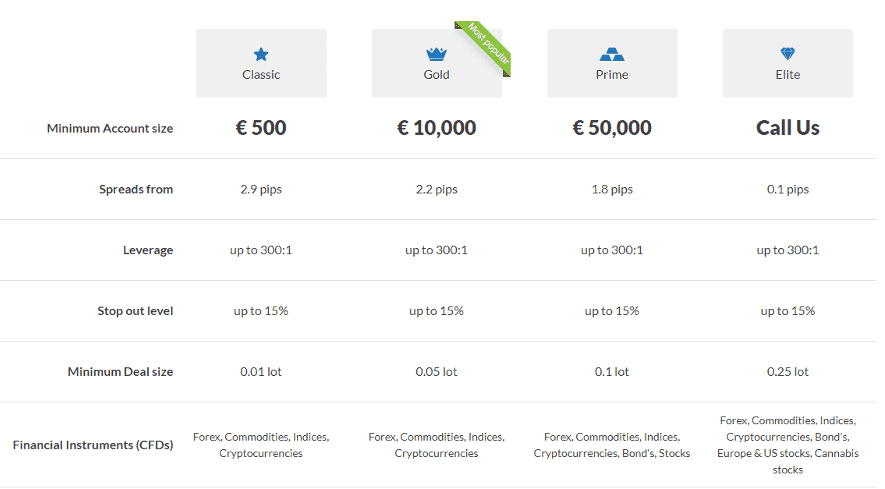

EAs are programs that monitor and trade markets using algorithms. They find opportunities according to set parameters and then either create a notification or automatically open a trade. ActivTrader provides market sentiment data, showing the percentage of traders that are long or short a particular instrument. ActivTrades showed a high level of transparency in their regulatory status, with a listing of all their entities and their regulators on their About page. Trading related costs such as spreads are clearly laid out for each asset class. Deposit and withdrawal fees are covered on the Account Funding page.

I like the attitude of activtrades to its clients as it shows that all of the people are different and we all have different habits and preferences in trading. Activtrades supports metatrader 4 and 5 along with its custom trading platform which is also appropriate for trading. I should note that this broker is not for newcomers. It’s no problem for experienced traders who might already have extra money to be invested, while newbies may need a smaller entry threshold – no more than $100. With my 5-year trading experience, I could afford investing more.

Is AvaTrade a trusted broker?

Yes, your money is as safe with AvaTrade as it would be with any online broker that is globally regulated in top-tier jurisdictions and authorized to hold its client's funds. AvaTrade is trusted by over 300,000 customers with millions of dollars in deposits.

The Securities Commission of the Bahamas authorizes and regulates it. No, ActivTrades is a market maker and not an ECN broker. ActivTrades provides one-on-one training sessions, while eToro continues its expansion into the cryptocurrency sector with the launch of an https://forexbroker-listing.com/ NFT fund. The EUR/USD carries an average spread of 0.72 pips, which is the lowest available. This broker is regulated in and compliant with two regulators and, therefore, a legit broker. Trading CFDs on leverage involves significant risk of loss to your capital.

Leverage

Following industry standards, new accounts are opened via an online application. After new traders obtain access to the back-office, verification is mandatory as stipulated by regulators to satisfy AML/KYC requirements. A copy of the trader’s ID and one proof of residency document generally completes this step.

- There are two types of accounts for retail and professional clients, which differ in their terms and conditions.

- Remember, most other platforms do not invest in such training, so it’s a plus if you choose ActivTrades based on this premise.

- However, you can use the MetaTrader 4 and MetaTrader 5 platforms on the desktop.

The spread is the difference between the buying and the selling price of any financial instrument. The spreads and commissions are clearly displayed on the official website of the broker. Apart from the Individual account, ActivTrades also offers a Professional account to eligible traders under the ESMA regulation. The broker also offers demonstration videos for traders who are not well acquainted with foreign exchange, CFDs trading, and financial markets.

Research tools

Some people do this, but you should realize that it’s not so easy to do. You need to take several trading courses, practice trading on a demo account and then it will take several years of hard work on a real account to become a professional trader. Activtrades is a top broker because of a variety of institutional features with appealing conditions. For example I like the account managing possibility with a bunch of settings. This way I can manage my clients’ accounts easily from my master account. This broker pleasantly surprised me closer to the end of the year.

The bonus policy seems somewhat unusual since traders are used to getting bonuses based on a percentage or specific money amounts. The gift bonus is a creative idea which is also not seen every day in the Forex market. ActivTrade is a company that was formed before the real Internet revolution and online trading. It dates back to 2001 when it was registered in England and Wales.

MetaTrader 4

ActivTrades offers demo accounts for ActivTrader platform, MetaTrader 4 and MetaTrader 5. This is especially important for beginners as it enables them to practise their strategies and get comfortable with the trading platform without risking any real money. Different regulators provide different levels of protection. For example, ActivTrades clients in the United Kingdom benefit from the oversight of the FCA. The FCA requires that clients have negative balance protection, which means that they cannot lose more than their deposit.

Is ActivTrades good?

ActivTrades has low trading fees. The account opening process is excellent and deposits and withdrawals are free. On the negative side, ActivTrades's product portfolio is slim and its research tools are basic. Also, there is a currency conversion fee and an inactivity fee.

Another advantage of the broker is its customer service which I happened to contact with. I was pretty satisfied with the service as my questions were answered very promtly and efficiently. Activetrades is not a bad option judging by the official information provided by the broker.

Why is it important to know where your broker subsidiary (entity) is regulated?

We verify some of our data for quality control but there are slight variations occasionally. We are not liable for losses that resulting from the information provided on our site. The seven-plugin update for MT4/MT5 at ActivTrades provides traders with a competitive edge. The cutting-edge proprietary trading platform at ActivTrades features market sentiment, hedging, and quality trading charts.

Is ActivTrades Safe and Reliable?

Yes, ActivTrades is reliable and safe and not a scam, since it is regulated by the leading authorities such as the FCA. The regulatory status of the ActivTrades broker is more than satisfactory and it provides the necessary security features such as segregated bank account, negative balance protection, and many more.

ActivTrades deposits can be made through bank transfers, credit/debit cards, or e-wallets. Coming to the ActivTrades Referral Program, the experience is exactly what most traders look for. With the platform’s ‘Refer a Friend’ program, users can earn $1000 for both the referer and the referee. Inactivity Fees – ActivTrades charges an inactivity fee of €10 per month if a trader keeps his trading account inactive for over a year. A powerful proprietary ActivTrader broker that provides fast executions, an intuitive interface, and the most efficient trading experience for all.

Is ActivTrades safe or scam?

Traders need to be careful and rollover when the volume decreases compared to the next contract. It is a regulated broker with multiple trading platforms. Perhaps beginners will choose ActivTrader, but for professionals there are MT4 and MT5. I want to say that ActivTrader is no worse than MetaQuotes software. There is everything you need and you can be sure of this because there is a free demo account.

ActivTrades is an online trading platform that offers trading in a variety of financial markets including forex, commodities, indices, and stocks. ActivTrades Corp offers funds protection insurance of up to $1 million. The trading platform uses different security measures to protect servers, payments, and client trades. One of the security measures supported by ActivTrades is encryption protocols, apart from negative account balance protection, funds protection, and segregated bank account.

I really try to get the most out of all the custom indicators, but smart order and smart lines are the most used by me, I think. Gotta get acquainted with everything before starting trading on a real acc. Btw, anyone knows, peculiarities of educational content here? I want to know about it in order to understand what information i should read an what – to miss. Frankly speaking, this broker is considered to be an acceptable one.

To open an individual account at the UK based ActivTrades PLC entity, prospective clients must answer the following questions. In order to achieve your trading goals, you need to choose the right account. We evaluate each broker’s account types, how easy it is to open an account with them, and the steps involved, so you can decide if it is worth your time to open an account. Knowledgeable and courteous agents were able to directly answer questions. This feature allows traders to execute orders with a single click and no secondary confirmation.

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types. It has all the assets imaginable; it is strongly regulated; it created its own proprietary platform that can be compared to metatraders. It took me a while to find a reliable broker, and I can tell you that I don’t regret choosing ActivTrades. ActivTrades also collects a minimum commission of 1 euro for the stock trading service in Europe. However, market data is free but is not offered in real time in MetaTrader 5 .

This is an average selection compared to its competitors. Cryptocurrency CFDs are also available, but only for those under the Bahamas-regulated entity. ActivTrades’s web trading platform is user-friendly and well-designed.

On 7 February 2023 they closed my account and cancelled all profits I made. They wrote me they closed my account because they believe I violated clause 9.14 and for that reason they cancelled arbitrarely all my profits made in weeks and weeks of trade. In order to be as much transparent as I can below my accounts credentials that everybody can check and see if I really did any « unfair » trade. We think that the demo accounts are the most useful because they allow you to become familiar with the platform and its features without any risks. There are other technical tools, like Application Programming Interfaces , which help implement an automated trading strategy. APIs allow traders to directly connect their screening software with their broker account to place orders.